Why Real Estate?

Real Estate is I.D.E.A.L.

Income

Real estate generates monthly income through rental and other fees

Depreciation

Depreciation or the tax benefits from owning investment real estate

Equity

Equity Buildup through increasing NOI and paying down the mortgage

Appreciation

Appreciation through rental increases

Leverage

Leverage which gives you the ability to control a large asset with a relatively small amount of capital

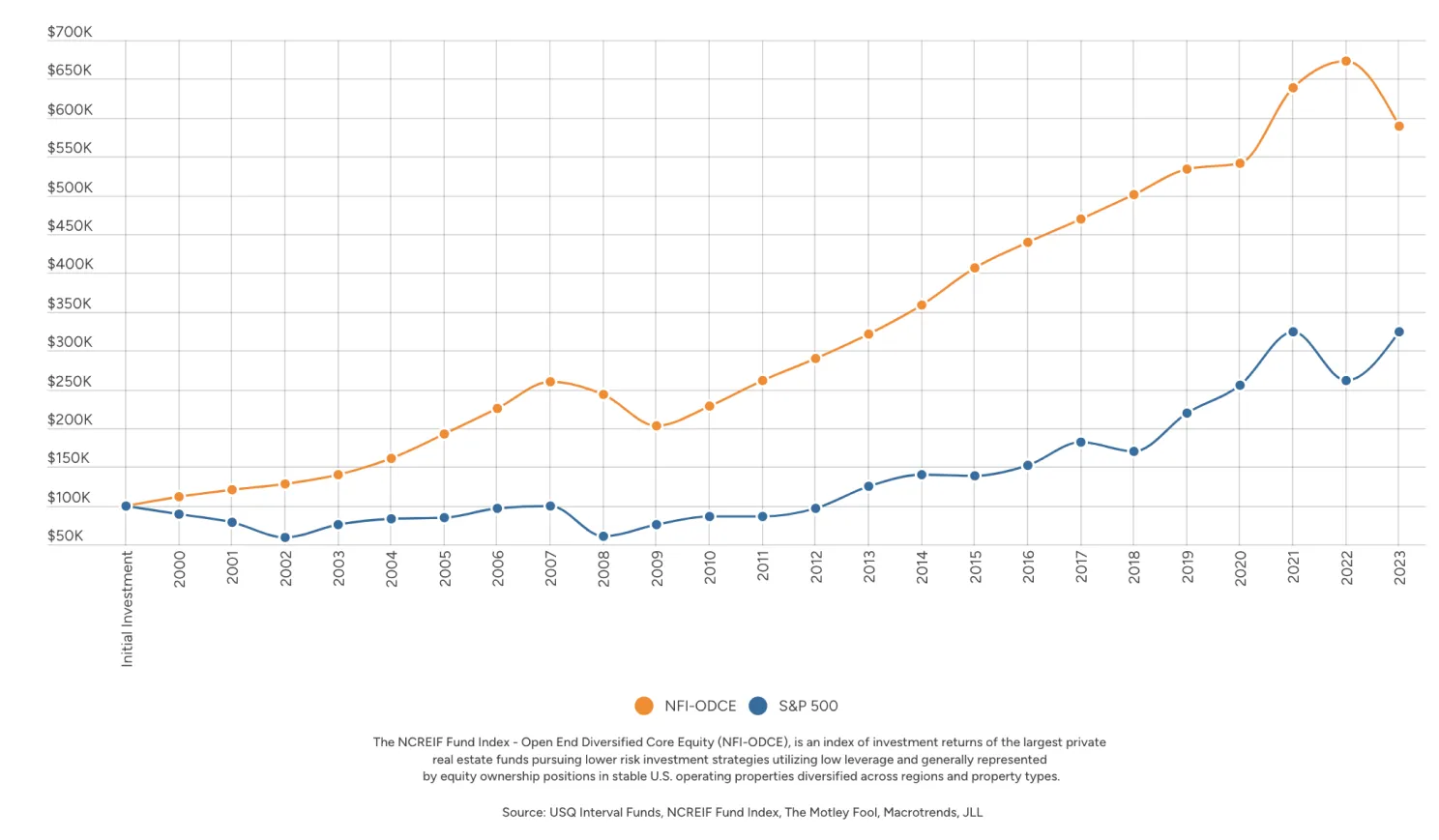

Real Estate vs. Stocks

This chart compares a hypothetical $100,000 investment in private real estate (NFI-ODCE) and the S&P 500 from 2000 to 2023. It highlights how adding real estate to a portfolio can diversify returns and potentially enhance overall growth, demonstrating a different trajectory than the stock market alone.

We’ve Made

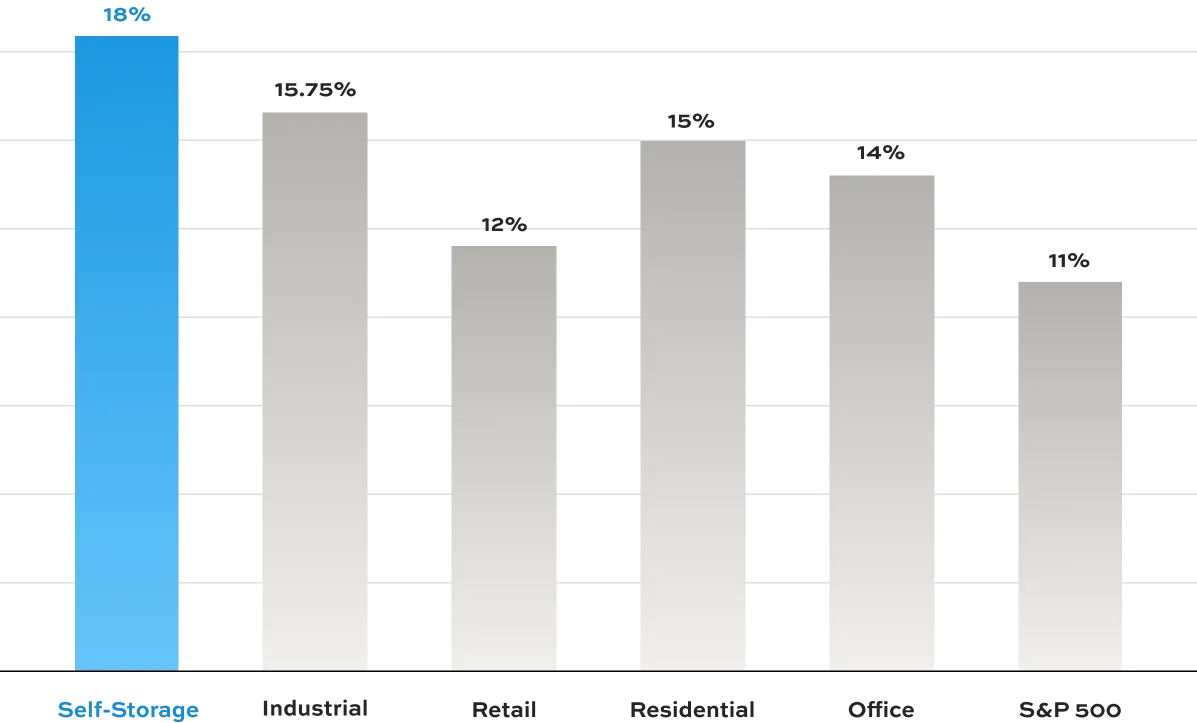

Self-Storage a Focus

While we have deep experience in acquiring, developing, and operating a diverse range of assets classes such as multi-family, industrial, retail in 2015 we concentrated on self storage due to the historical returns outperforming all other asset classes.

Self-Storage vs Other Asset Classes

Chart showing average rate of return by asset class over the last 28 years.

Source: Nareit

Why Self-Storage?

Higher ROI

Lower operational expenses and higher ROI compared to other real estate asset classes.

Economic Resilience

Economic resilience, performing well in both upturns and downturns.

Business Model Flexibility

Flexible business model with various unit types and additional revenue streams.

Simplified Tenant management

Simplified tenant management with fewer regulatory challenges.

Scalability and Diversified

Scalability and diversified income from numerous units.

Historically Resilient

Historical resilience during economic downturn